boulder co sales tax efile

The Boulder County Sales Tax is 0985 A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. Monthly returns are due the 20th day of month following reporting period.

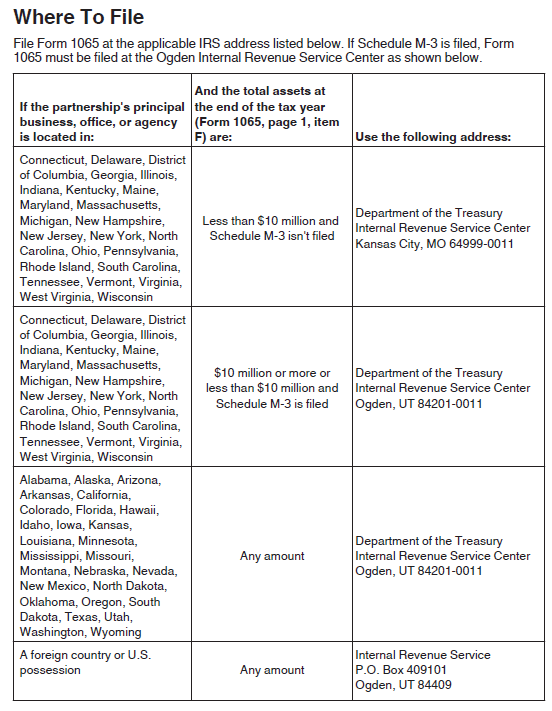

Filing Your Investment Club Taxes Bivio Investment Clubs

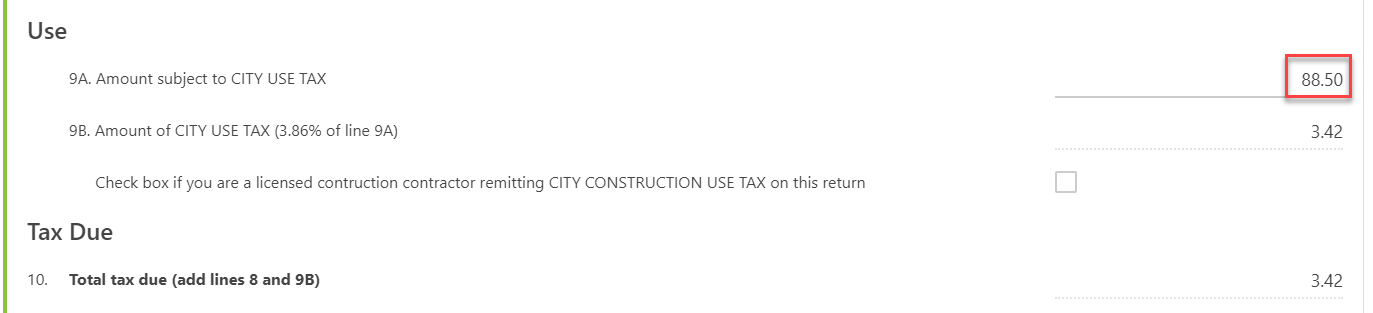

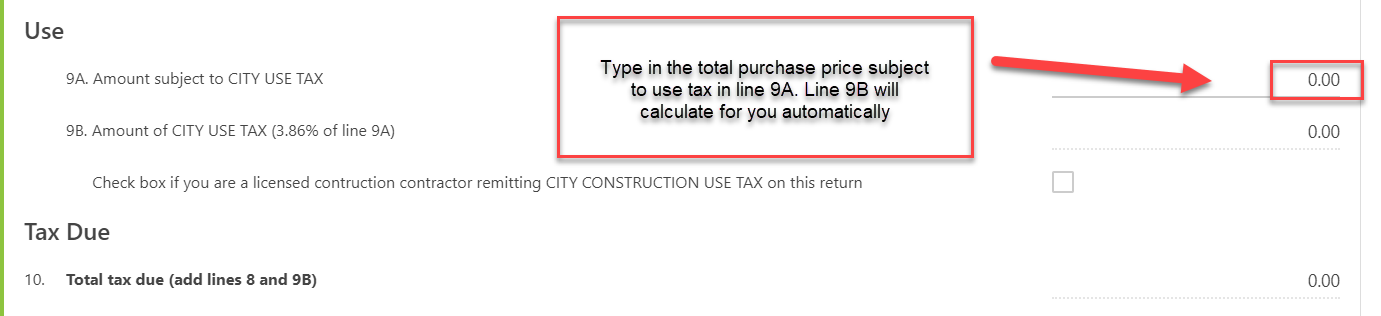

The city use tax rate is the same as the sales tax rate.

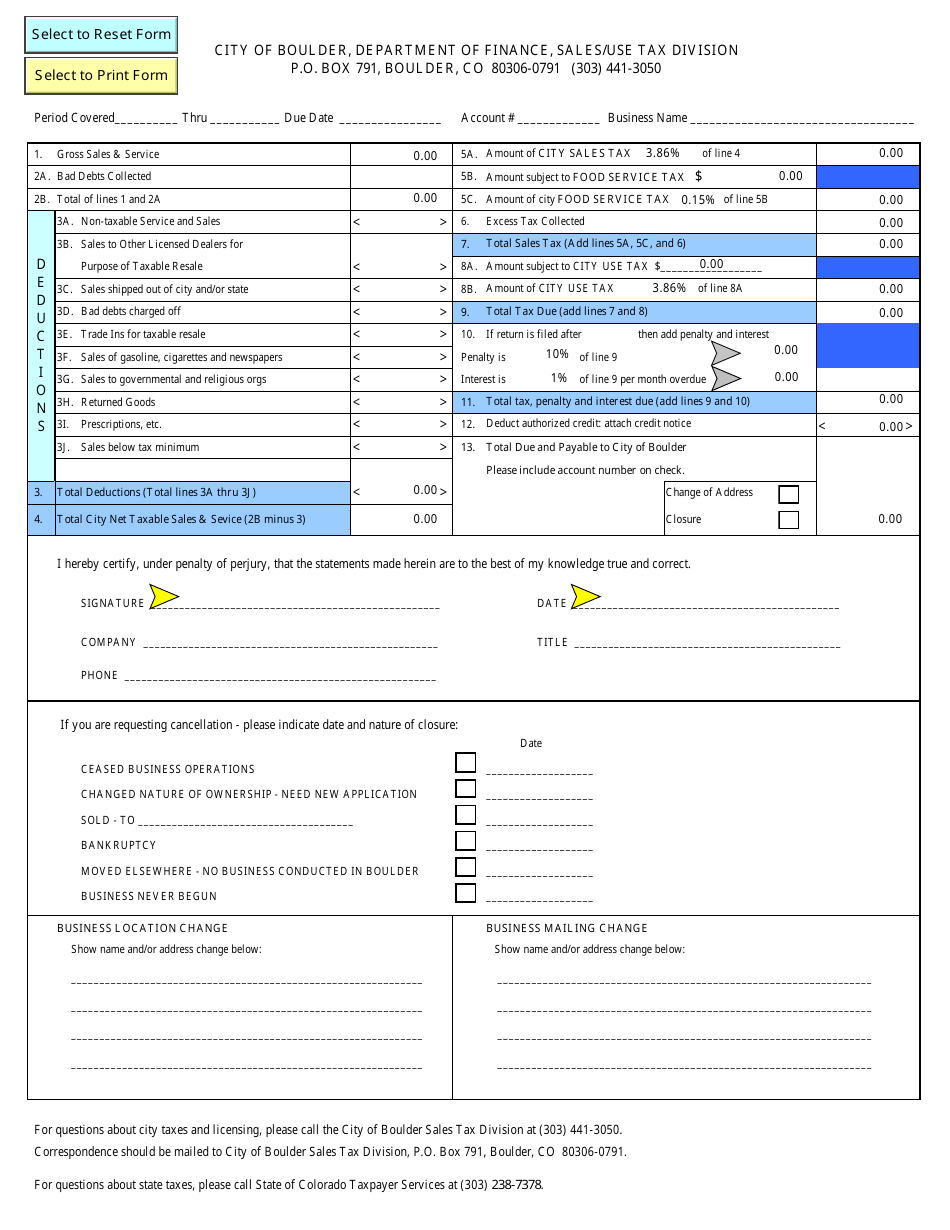

. I hereby certify under penalty of perjury that the statements made herein are to the best of my knowledge true and correctFor questions about city taxes and licensing please call the City of Boulder Sales Tax Division at 303 441-3050Correspondence should be mailed to City of Boulder Sales Tax Division P O. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. There is no provision for any po rtion to be retained as a vendor fee.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. For questions about state taxes please call State of Colorado Taxpayer Services at. There is no applicable city tax.

Complete a Business License application or register for a Special Event License. The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. A Penalty for late filing 10 for line 7 8 B Interest for late filing 1 per month of.

Boulder Colorado 80306 Single Event 303 441-3050 or 441-3051 Please State Date _____. 10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. The Boulder sales tax rate is.

Sales tax returns must be filed monthly. 417 Year Tab Replacement. What is the sales tax rate in Boulder Colorado.

The minimum combined 2022 sales tax rate for Boulder Colorado is. 820 Duplicate title. Complete Sign Send the City Of Boulder Sales Tax Forms.

Department of Finance - SalesUse Tax Division Type of Event _____ PO. That are not resold or remanufactured by you. 80301 80302 80303 80304 80305 80306 80307 80308 80309 80310 and 80314.

Email at salestaxbouldercoloradogov or send a message through Boulder Online Tax. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division.

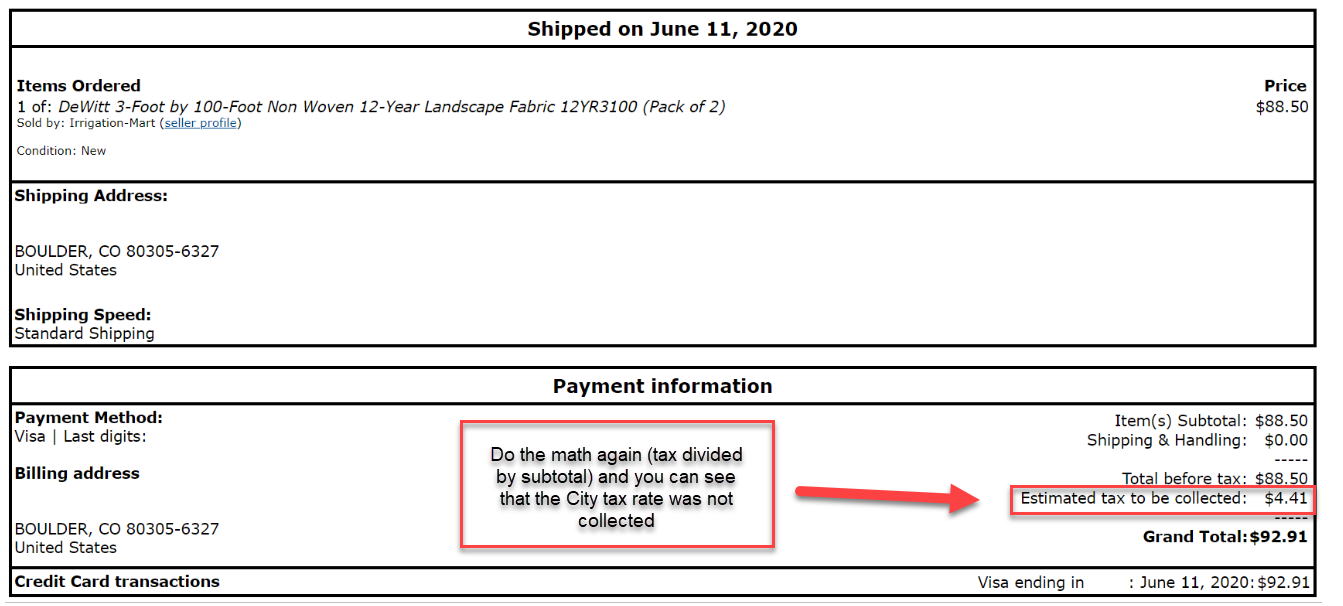

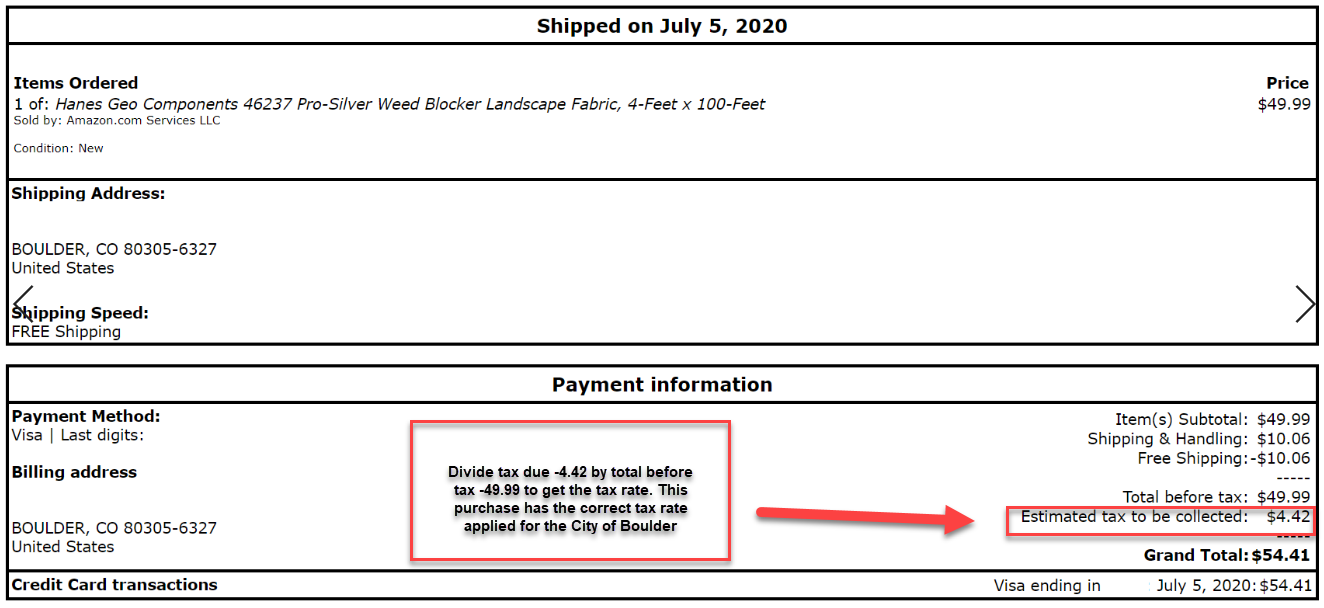

How to Apply for a Sales and Use Tax License. The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

This includes purchases and leases of equipment materials supplies etc. If you have more than one business location you must file a separate return in Revenue Online for each location. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations.

There are a few ways to e-file sales tax returns. Use Tax The City also has a 35 Use Tax. Some cities and local governments in Boulder County collect additional local sales taxes which can be as high as 51.

350 Homemade trailer ID. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. You can print a 9 sales tax table here.

Return the completed form in person 8-5 M-F or by mail. The County sales tax rate is. Wayfair Inc affect Colorado.

Sent direct messages to Sales Tax Staff. Electronic Signature Forms Library Tax Forms Colorado Tax Forms Get and Sign City of Boulder Sales Tax Form Get and Sign City of Boulder Sales Tax Form Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. All businesses in the City of Englewood are liable for the 35 tax on the tangible personal property used or consumed in their business.

400 Duplicate registration. Boulder County has enacted Level 1 Fire Restrictions. Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017.

Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City. Box 791 Check one Regular - Business. Businesses that pay more than 75000 per year in state sales tax.

Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists of a 099 county sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. 7 Total Net Tax due.

Did South Dakota v. This tax must be collected in addition to any applicable city and state taxes. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax.

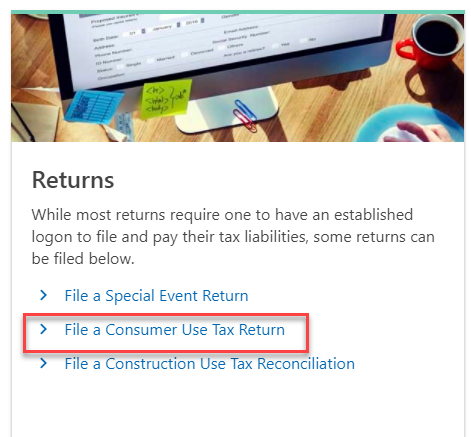

The Colorado sales tax rate is currently. Show details How it works Open the boulder online tax gentax cpc and follow the instructions. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to.

428 Year and Month Tab Replacement. Boulder Countys tax rate is 0985. The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax.

The Boulder Colorado sales tax rate of 8845 applies to the following eleven zip codes. For additional e-file options for businesses with more than one location see Using an. 300 or more per month.

720 Title print only. Property Data. This is the total of state county and city sales tax rates.

There are approximately 87879 people living in the Boulder area. If a lien is filed on the title filing fees for the security agreement document will depend on the size and number of pages. An alternative sales tax rate of 8855 applies in the tax region Lafayette which appertains to zip code 80301.

File online tax returns with electronic payment options.

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Sales Tax Campus Controller S Office University Of Colorado Boulder

![]()

Tax Accountant For U S Expats International Taxpayers Us Tax Help

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Consumer Use Tax How To File Online Department Of Revenue Taxation

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Tax Accountant For U S Expats International Taxpayers Us Tax Help

Sales And Use Tax City Of Boulder

File Sales Tax Online Department Of Revenue Taxation

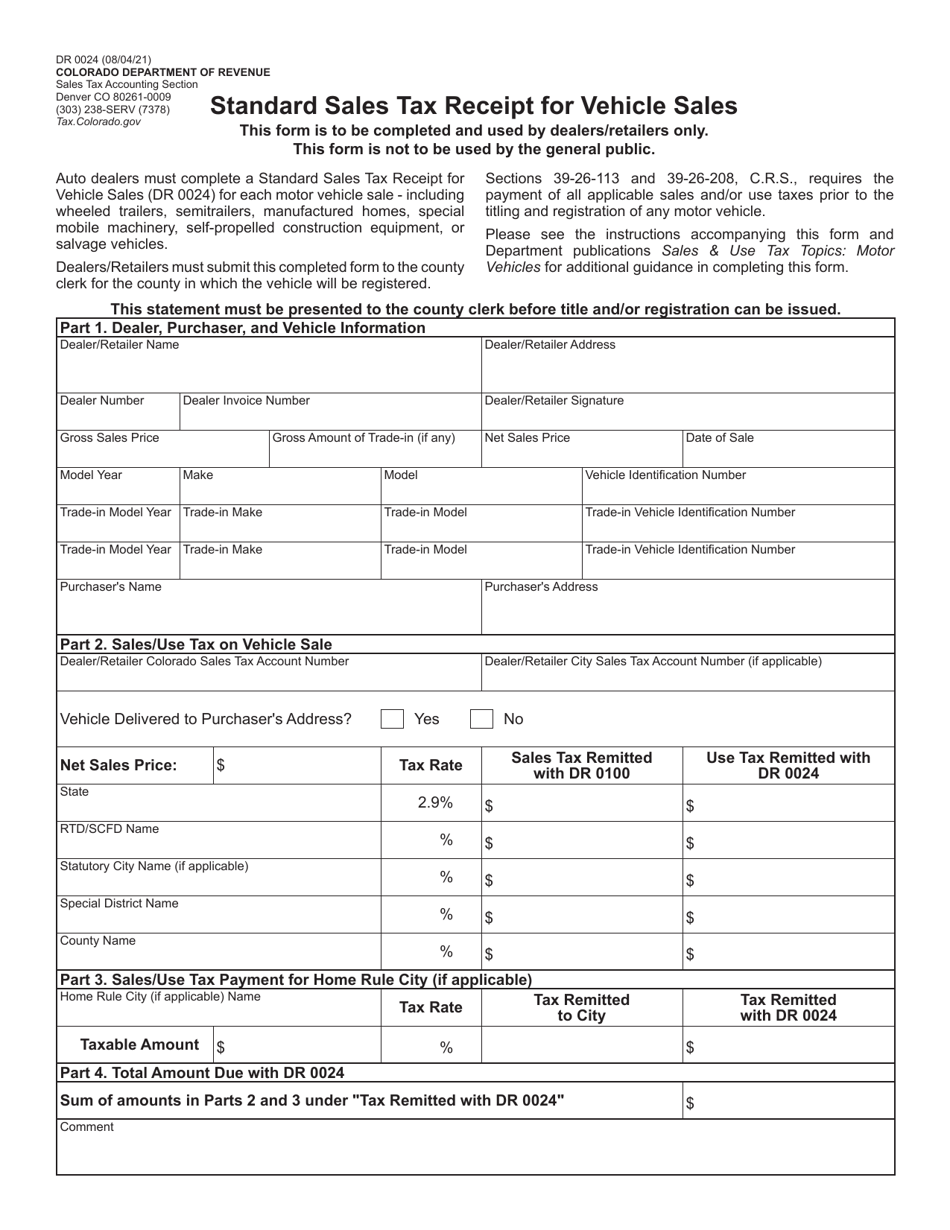

Form Dr0024 Download Fillable Pdf Or Fill Online Standard Sales Tax Receipt For Vehicle Sales Colorado Templateroller